How to qualify to become a registered tax agent in 2022

Whether you're an accountant that has recently moved to Australia, your have other qualifications or you're looking for a new career direction, to become a tax agent you will need to meet the requirements as set out by the Tax Agent Services Regulations and register with the Tax Practitioners Board (TPB).

Study time 7200 minutes

From AUD 545

Requirements for Registration

Required Skills:

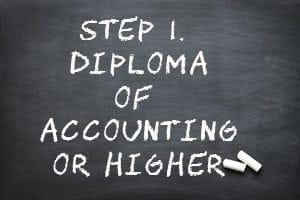

How to meet the education requirements

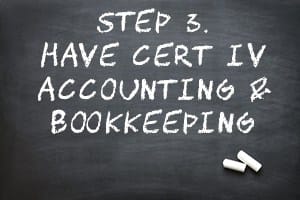

Tax Practitioners Board to ascertain what additional Board Approved courses in Australian taxation and commercial law you need to complete.

Complete the TPB online self-assessment tool. This will confirm which units you need to enrol in -Click here to get the TPB Self Assessment Tool.

Then go to Step 5.

You have relevant working experience for at least 12 months in the past 5 years, contact the Tax Practitioners Board.

The TPB will assess your qualifications and experience and confirm what additional qualifications you need. Contact the TPB.

Then go to Step 5.

Apply for credit transfer to enrol in FNS50217 Diploma of Accounting + Tax.

Our credit transfer system is simple and efficient to use. Fill out your contact details, upload your results/statement of attainment and we will confirm your enrolment within a few days. Click here to upload your prior studies.

Enrol in FNSSS00014 Accounting Principles Skill Set. This skill set is the entry requirement to the Diploma of Accounting + Tax.

If you have 8 years of full time experience or more in the past 10 years, we recommend that you contact the TPB for an assessment of your work experience before enrolling in a course.

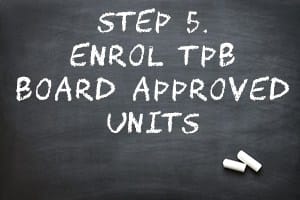

Enrol in your required Board approved tax units. Choose the units here.

The maximum duration of our courses depends on which course or unit you are enrolled in.

Our courses are delivered online, this means that they are self-paced and flexible to fit around your work and family commitments. Depending on your time available and accounting and bookkeeping knowledge, the courses can be completed faster than the maximum time allowed.

Contact the TPB with your new qualifications, you have now met the education requirements to become a registered Tax Agent. Contact the TBP for their next steps.