Payroll

All Posts

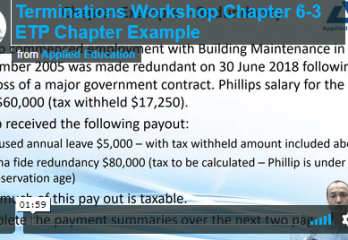

We are pleased to advise the Terminations Workshop Online course has been updated for 2017-2018. If you need to process an ETP (Employment Termination Payment) or Redundancy with Lump Sum payments then this is the course for you. Full course details can be found here

Read MoreIt is simply a three way agreement between an employer, an employee and a financier. Brett Thornett from Applied Education explains in detail below; Find out more in our Salary Packing Course or Bookkeeping & Accounting Courses

Read MorePayroll Administration in Australia 2017-2018 Online learning is now available for all our students who are enrolled in Certificate III to Advanced Diploma Bookkeeping and Accounting courses. Some of the new content discussed are single touch payroll and Workplace Gender Equality Act 2012 reporting requirements. Full Course Content https://www.appliededucation.edu.au/payroll-taxation/payroll-administration Students access the course via your […]

Read MoreAn article published by BDO Australia discusses the importance of reviewing payroll provider services with a particular focus on tax obligations. The article states that where a business employs staff, that business has the obligation to ensure the tax withheld from employees’ wages is remitted to the Australian Taxation Office (ATO). Under some arrangements payroll […]

Read MoreHow to setup long service leave in accounting software. By Brett Thornett from Applied Education Online Learning.

Read More

![What is a novated lease? [Video] 2 What is a novated lease? [Video] 1](https://www.appliededucation.edu.au/wp-content/uploads/2017/09/novated-lease-348x240.png)

![How to set up working holiday employees in MYOB [Video] 6 How to set up working holiday employees in MYOB [Video] 2](https://www.appliededucation.edu.au/wp-content/uploads/2017/03/working-holiday-employees-348x240.png)

![How to set up Long Service Leave in your accounting software [Video] 7 How to set up Long Service Leave in your accounting software [Video] 3](https://www.appliededucation.edu.au/wp-content/uploads/2017/03/long-service-leave-348x240.png)