WINTER SALE

Pay upfront and SAVE 15%

Ends 31 July 2025

Certificate in Xero Accounting and Certificate in Xero Payroll

Enrol in any of our comprehensive Xero Online courses to attain a strong command of Xero accounting software, Xero Bookkeeping and Xero Payroll. Save time and stress by studying the Xero course that matches your needs. Ideal for accounts administrators, accounts payable & receivable officer, accountants, bookkeepers and small business owners who are wanting to learn Xero accounting software.

New Course Release! Payroll Course Latest Xero Interface and Lessons

-

Online Learning

-

30+ parts per course

-

5 CPD hours per course

-

Certificate of completion

-

Instant access, start NOW!

Xero Course Options

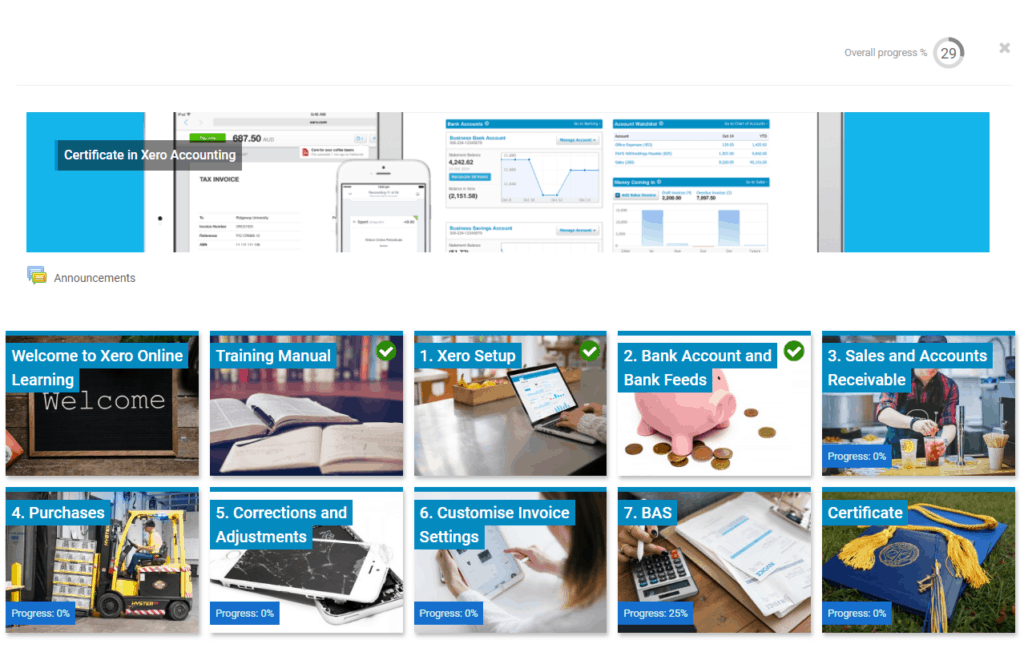

Certificate in Xero

Accounting

Xero Bookkeeping Training Course

5 CPD Study Hours

Digital training manual included

Follow along with the practical exercises

$209 RRP $245

Payment Plan Available $31.67 per week for 9 weekly instalments

*Sale price valid pay up front in full only

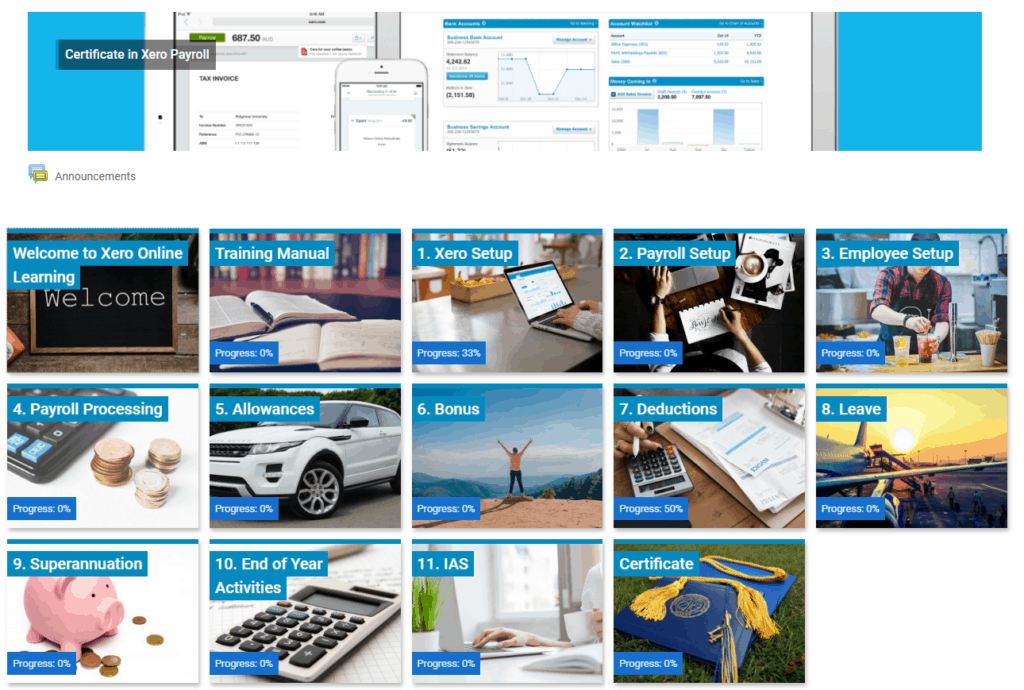

Certificate in Xero

Payroll

Xero Payroll Training Course

5 CPD Study Hours

Digital training manual included

Follow along with the practical exercises

$209 RRP $245

Payment Plan Available $31.67 per week for 9 weekly instalments

*Sale price valid pay up front in full only

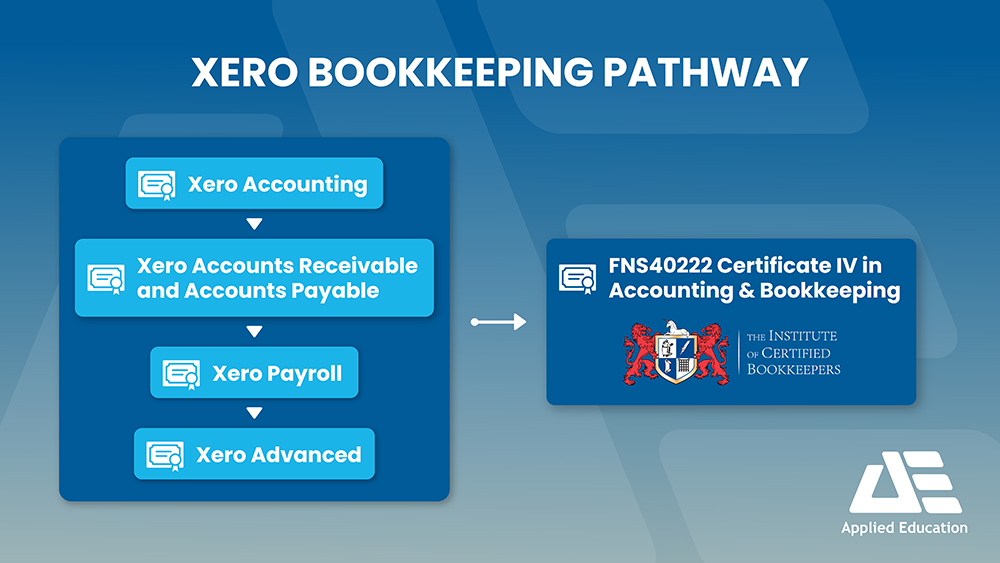

Xero Bundle

Online Learning

Accounting, Payables & Receivables, Payroll and Advanced Courses

25 CPD Study Hours

Four course bundle

Digital training manuals included

$506 RRP $595

Payment Plan Available $70.56 per week for 9 weekly instalments

*Sale price valid pay up front in full only

-

Xero Experts

Accounting Software Training experts since 1999

-

Online Tutorials

Instant Access

-

Amazing Support

Experienced trainers and passionate support

-

PDF Resources

Australian written learning material

Our Xero-Certified Trainers

Brett Thornett

Brett Thornett

Brett has over 20 years experience at the forefront of accounting software training. Applied Education was one of the first companies in Western Australia to deliver and write Xero Accounting training courses, and we pride ourselves on our outstanding accounting knowledge and experience to deliver a thorough and comprehensive training course.

Dan Logan

Dan Logan

Dan is a Xero-certified trainer at Applied Education and a specialist in IT Systems & Applications and Project Management. His in-depth knowledge and practical experience in Enterprise Computing, Microsoft applications, Google Suite and more recently cloud architecture implementations. Dan’s passion in education began with his early role as a high school teacher.

Brett Thornett

Brett Thornett Dan Logan

Dan Logan