WINTER SALE

Upskill now and Save 10%

Ends 31 July 2025

Direct Entry Diploma of Accounting Online

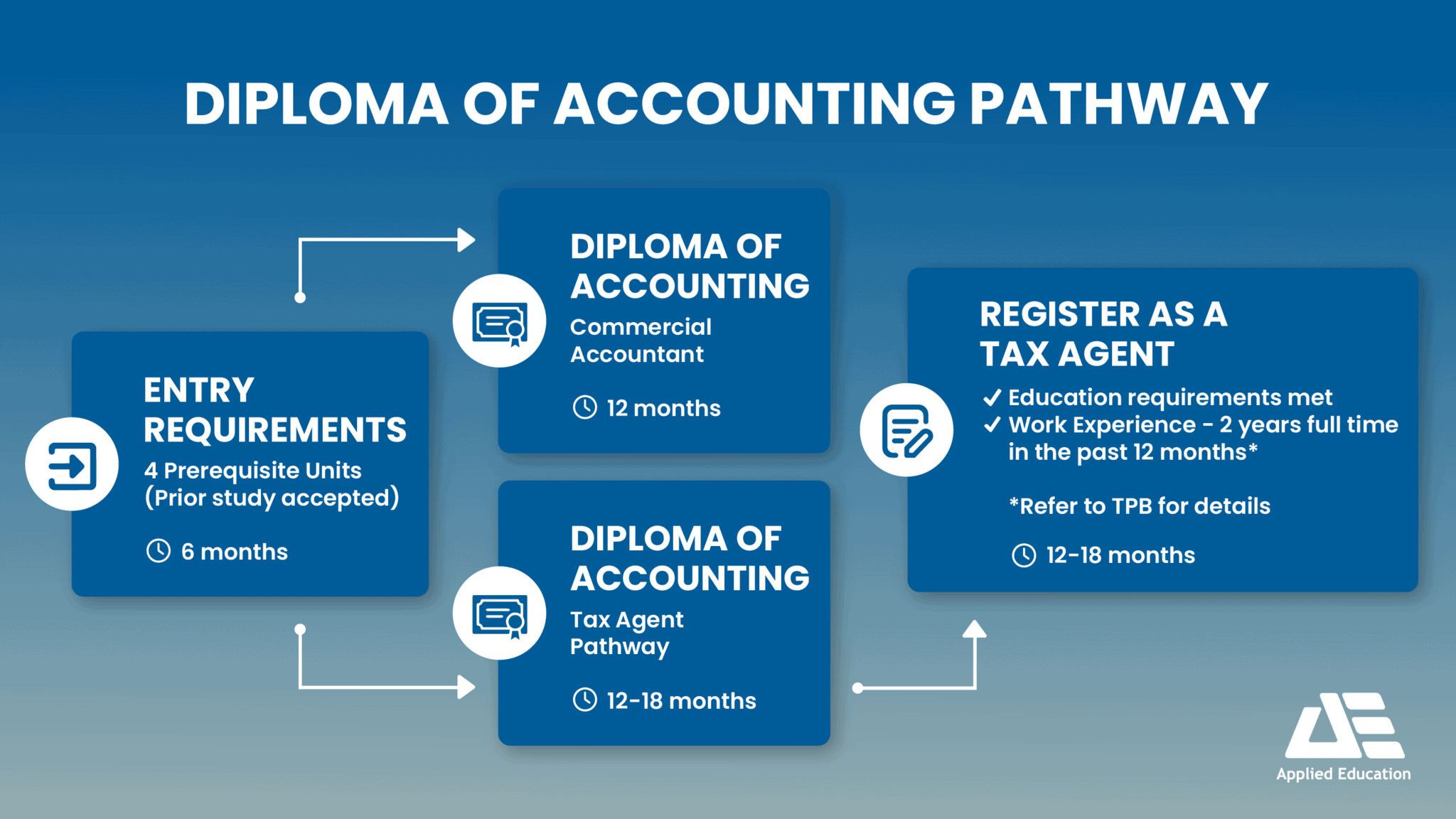

The FNS50222 Diploma of Accounting course is designed for students wanting to become accounting professionals or tax agents and have prior qualifications.

Applied Education offers choices for the Diploma of Accounting depending on your career pathway and preferred learning styles. You can choose to study units that are relevant to commercial accounting or units relevant to taxation accounting and are approved by the Tax Practitioners Board for Tax Agent registration.

On completion of FNS50222 Diploma of Accounting, you will be able to:

- Prepare reports for corporate entities

- Prepare tax documents for individuals

- Provide business performance reporting

- Produce and analyse budgets

- Implement internal control procedures

- Perform management level accounting tasks

Get the course guide!

"Am I ready to study checklist?" included

LG FNS50222 2023

FNS50222 Diploma of Accounting Enrolment Options

Prior qualification

Do you have a prior qualification that meets the entry requirements to the Diploma of Accounting?

Yes

Great news. Choose between commercial accounting or tax accounting / tax agent and enrol.

No

No problem. Choose between commercial or tax accounting / tax agent, enrol and complete the entry requirements first.

You Meet Entry Requirements

Include the Entry Requirements

Diploma of Accounting

Commercial Accounting

11 Units

Payment Plans Available

Meets BAS Agent Education Requirements

$2241 RRP $2490

Diploma of Accounting

✔ with Tax Electives

Taxation Accounting

11 Units

Payment Plans Available

Meets Tax Agent Education Requirements

$2682 RRP $2980

Diploma of Accounting

and prerequisite units

15 Units

Commercial Accounting

Payment Plans Available

Meets BAS Agent Education Requirements

$2691 RRP $2990

Diploma of Accounting

✔ with tax electives

and prerequisite units

15 Units

Taxation Accounting

Payment Plans Available

Meets Tax Agent Education Requirements

$3087 RRP $3430

Not sure which course is right for you? Completed prior units and may be eligible for credits? Call us on 1800 678 073 for a consultation with an Enrolment Advisor or book an enrolment consultation.

Video Recordings

Hours of lectures, tutorials and classroom recordings

Tax Practitioners Board Approved

TPB approved for Tax Agent registration

Amazing Support

Expert trainers and passionate support

Student Membership

with IFPA (Institute of Financial Professionals Australia)

Free Short Course Bundle Included

Choose 1 FREE Fundamentals bundle or 2 for $295, or all 3 for $495 when you enrol.

Perfect to meet CPE/CPD requirements and upskill

* If you are applying for funding for this course, there may be restrictions on Free Bundles depending on government funding eligibility requirements.

Student Membership Included

Institute of Financial Professionals Australia

Applied Education has partnered with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) to provide you with the tools and resources you need to thrive in your study and professional career.

Tax students* at Applied Education receive, at no additional cost, a 12-month Student Membership with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia). This membership is specifically designed to help you complete your study and prepare you for your future career as a Tax Professional with one of Australia's leading Tax Associations.

*This offer is available if you enrol in the Tax Agent Registration Course, Diploma of Accounting with tax electives or Advanced Diploma of Accounting. Key benefits to this membership include:

For information on the full range of benefits of this Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) membership, click here.

Student Support - The Applied Education Difference

Amazing Support

Every student receives help getting started

and can book a welcome callOnline Support

Dedicated Support Team and Ticket Lodgement

Facebook & Student Forums

Dedicated Facebook Study Group and Online Forums

Phone Support

Talk to Assessors & Student Services Team

Accreditation & Industry Partners

As a Registered Training Organisation (ID 52240), we comply with the government’s strict quality and consistency standards. We conduct regular audits to ensure we keep this accreditation and deliver the level of training you deserve.

Nationally Recognised Training - FNS50222 Diploma of Accounting is nationally recognised in all states and territories of Australia.