If you are looking forward to a career as a Registered Tax Agent, Applied Education has a variety of pathways to get you there as fast as possible. Our tax agent courses will provide you with all skills you will need to meet the educational requirements to be a Registered Tax Agent.

Pathway Options to Become a Tax Agent

Degree in Accounting or another discipline?

Add Tax Agent Units only

From 1 to 6 units of study

Australian Taxation Law + Commercial Law Units + Basic Accountancy Principles

Enrol in only the units you need, all Tax Board approved

Student Membership with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia)

Online Learning - start anytime, study units in any sequence

Direct Entry

Diploma of Accounting with tax electives and prerequisite units

Up to 15 units of study

Ideal for those with experience in accounting without the required qualification

Gain the skill set for direct entry to the Diploma of Accounting

Credit transfers available, contact us to discuss

Achieve the Diploma with the tax units included

Not sure which course is right for you? Completed prior units and may be eligible for credits? Call us on 1800 678 073 for a consultation with a course coordinator or book an enrolment consultation.

If you are looking forward to a career as a Registered Tax Agent, Applied Education has a variety of study options to get you there as fast as possible. Our tax pathway courses will provide you with all skills you will need to meet the educational requirements to be Registered Tax Agent.

What is the Tax Agent Pathway?

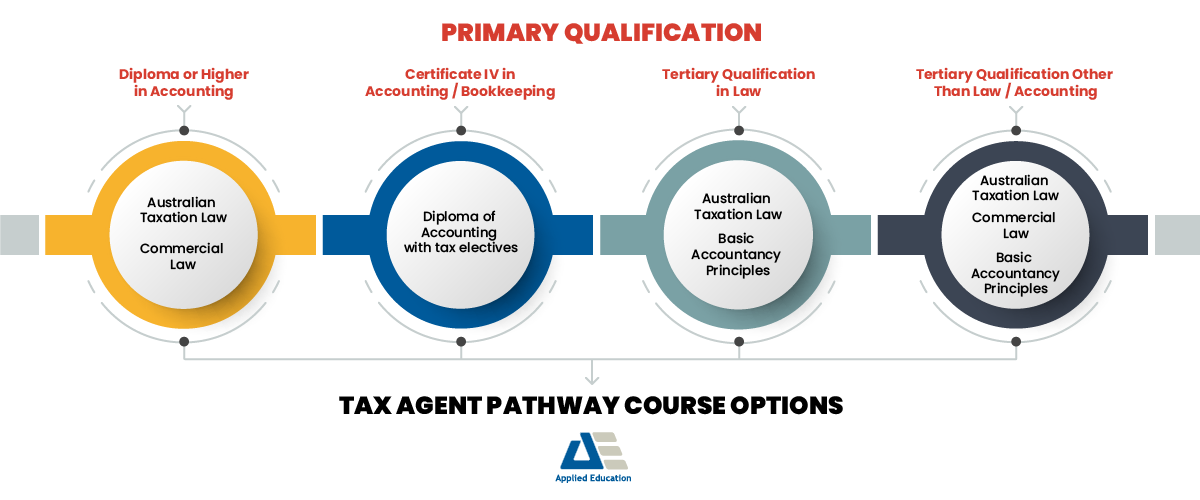

We offer 4 pathways to becoming a Tax Agent.

- No formal qualification? You need to start with the prerequisite Units. Once this is completed, we credit transfer you into the Diploma of Accounting with tax electives which contains the required TPB Tax Agent units.

- Completed a course like the Certificate IV in Accounting and Bookkeeping, then we will credit transfer you into the Diploma of Accounting with tax electives.

- Already have a degree other than Law or Accounting? Study the Tax Practitioners Board approved courses

- Have a Diploma of Accounting or higher? Enrol in only the Tax Agent Registration units that you need to completed as confirmed by the Tax Practitioner Board (TPB).

Institute of Financial Professionals

(formerly known as Tax & Super Australia) Student Membership included

Tax Practitioners Board Approved

TPB approved for BAS Agent registration

Amazing Support

Expert trainers and passionate support

Online Video Learning

Tutorials available for key learning concepts

Student Membership Included

Institute of Financial Professionals Australia

Applied Education has partnered with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) to provide you with the tools and resources you need to thrive in your study and professional career.

Tax students* at Applied Education receive, at no additional cost, a 12-month Student Membership with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia). This membership is specifically designed to help you complete your study and prepare you for your future career as a Tax Professional with one of Australia's leading Tax Associations.

*This offer is available if you enrol in the Tax Agent Registration Course, Diploma of Accounting with tax electives or Advanced Diploma of Accounting. Key benefits to this membership include:

For information on the full range of benefits of this Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) membership, click here.

How to become a Tax Agent

The education requirements to become a Tax Agent, as set by the Tax Practitioners Board, that you need to acquire are:

From AUD 545

Required tools:

Required qualifications

These requirements include a primary qualification, Board-approved courses, relevant experience and other criteria.

Being a nationally recognised Diploma of Accounting or higher. If you don't have one, consider getting a nationally recognised an accounting qualification from Applied Education.

Board approved courses must be undertaken with an approved course provider for it to count towards meeting the education requirements for registration as a tax agent, BAS agent or tax (financial) adviser.

- relevant work experience.

- be over 18 years of age and a fit and proper person.

- have the required professional indemnity insurance.

Student Support - The Applied Education Difference

Amazing Support

Every student receives help getting started

and can book a welcome callOnline Support

Dedicated Support Team and Ticket Lodgement

Facebook & Student Forums

Dedicated Facebook Study Group and Online Forums

Phone Support

Talk to Assessors & Student Services Team

Accreditation & Industry partners