Taxation

All Posts

The opposition is proposing a hefty increase in penalties for those found marketing tax avoidance schemes, should they win the next election. In recent years the Australian Taxation Office has begun a crackdown on accountants and lawyers who are found to promote tax avoidance schemes to their clients. Corporate entities can face fines of up […]

Read MoreGenerally, you must apply to renew your registration at least 30 days before it expires. You will remain registered until we make a decision on your application. If approved, your registration period will be renewed for at least three years. Full details of the can be found on the Tax Practitioners Board Website. Applied […]

Read MoreThe Tax Practitioners Board (TPB) is urging Tax Financial Advisers who need to renew their registration by 1 January 2018 to get in early as almost 13,000 other practitioners will be due to renew at the same time. Chair of the TPB, Mr Ian Taylor, encouraged tax (inancial advisers to renew early to avoid application […]

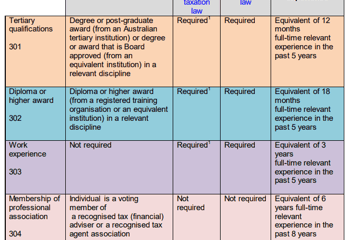

Read MoreThe TPB have published a very useful resource for Tax Financial Advisers who need to renew their license. The key steps in the process are: Determine your representative status Review the required qualification and relevant experience Determine if a board approved course for tax (financial) advisers is required to be completed – Applied Education’s unit and […]

Read MoreIf you are a Tax financial advisor who has registered with the Tax Practitioners Board (TPB) under the Notification or Transitional option, are you aware that you will have to fulfil a number of requirements before you can re-register under the Standard Option? To apply to register or renew your registration as a tax (financial) […]

Read MoreIf you have more than one payer at the same time, the ATO generally require that you only claim the tax-free threshold from the payer who usually pays the highest salary or wage (this is known as the primary source of income). If you earn additional income (for example, from a second job or a […]

Read More- « Previous

- 1

- 2