WA Traineeships

A traineeship is a practical hands-on training program; it's employment that combines work and structured training. It’s a way of upskilling or gaining the knowledge and ability to understand the most up-to-date terminology, software and skills, giving you the confidence to win a place in today's workforce. Upon successful completion of your traineeship you will receive a nationally-recognised qualification.

Eligibility

- Are you currently living in Western Australia?

- Aged 15 or old and not at school?

- Do you work more than 15 hours per week?

- Do you have a manager/supervisor?

- Have you been employed for less than 3 months in your current role?

- Are you an Australian Citizen or Permanent Resident?

If you answered 'yes' to all of these questions and you do not currently hold a Certificate IV or higher qualification then you may be eligible for Government funding through the traineeship scheme.

Get the course guide!

"Am I ready to study checklist?" included

LG WA Trainee Funded

Traineeship Course Options

We have three courses that are approved for WA-funded traineeships.

FNS40222

Certificate IV in

Accounting and Bookkeeping

Become a professional bookkeeper

Includes hundreds of video tutorials

ICB Student Membership

digital learning material

bonus upskill courses

dedicated support

Tax Practitioners Board Approved for BAS Agent Registration

$2080.00

or $620.80 for concession

FNS30322

Certificate III in

Accounts Administration

Begin your bookkeeping career

Includes video tutorials

digital learning material

bonus upskill courses

dedicated support from

our expert trainers

Learn day-to-day accounts functions for your organisation

$1592.50

Or $475.30 for concession

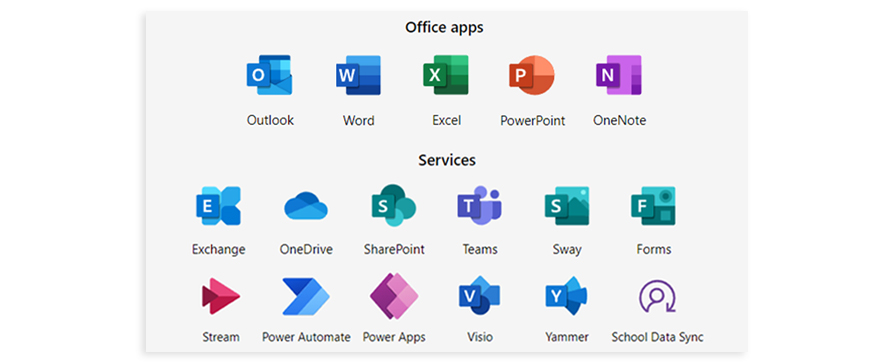

BSB30120

Certificate III

in Business (Administration)

Begin your business career

Includes video tutorials

digital learning material

bonus upskill courses

dedicated support from

our expert trainers

Learn admin skills and knowledge for a broad range of industries

$1592.50

Or $475.30 for concession

*The student tuition fees are indicative only and are subject to change given individual circumstances at enrolment.

Additional fees may apply such as resource fees and other fees.

🎓 Not sure which course is right for you? Let’s find your fastest path!

If you’ve completed prior study, you could earn credits towards your qualification.

Call 1800 678 073 or book a FREE enrolment consultation with a course advisor today and get expert advice.

What are the benefits?

- Opportunity to gain a nationally recognised Certificate IV or Certificate III qualification.

- Attend classroom sessions (if being held) at no additional cost to the trainee and more than once if required

- Utilise our learning facilities for self study (when available)

- Plan for your future and help your employer develop the skills of their workforce

- Commencement and completion incentives for employers

What support is provided to trainees?

- Regular contact from one of our skilled team

- Training plan

- Online forums

- Email or telephone contact with trainer/assessor

- Dedicated Facebook support group

- Online activities

- Bonus short courses

- Dedicate Support Team

Not eligible for Traineeship funding? click below for more information:

FNS40222 Certificate IV in Accounting and Bookkeeping

FNS30322 Certificate III in Accounts Administration

BSB30120 Certificate III in Business

Interested in a Traineeship?

For further information about our courses as a trainee, enrolment process and fees, please book an enrolment consultation or contact us on (08) 9221 0955 or enrol@appliededucation.edu.au

Student Support - The Applied Education Difference

Amazing Support

Every student receives help getting started

and can book a welcome callOnline Support

Dedicated Support Team and Ticket Lodgement

Facebook & Student Forums

Dedicated Facebook Study Group and Online Forums

Phone Support

Talk to Assessors & Student Services Team

Accreditation & Industry Partners

As a Registered Training Organisation (ID 52240), we comply with the government’s strict quality and consistency standards. We conduct regular audits to ensure we keep this accreditation and deliver the level of training you deserve.

Nationally Recognised Training - FNS40222 Certificate IV in Accounting and Bookkeeping, FNS30322 Certificate III in Accounts Administration and BSB30120 Certificate III in Business are recognised in all states and territories of Australia.