An alternative pathway to becoming a registered tax agent in Australia

Want to become a tax agent but don’t have a diploma or degree in accounting?

If you hold Tertiary qualifications in law or another discipline other than accounting there is an alternative pathway available to be become registered as a tax agent. Rather than doing an entire Diploma (or higher) of Accounting you are able to complete the units shown in the table below.

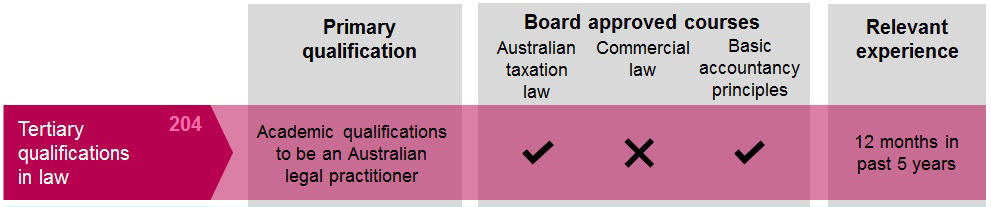

Pathway for holders of a Law Degree / Qualification

If you have a law degree you will need to complete our courses in:

Basic Accounting Principles approved by the board

- FNSACC421 Prepare financial reports

- FNSACC414 Prepare financial statements for non-reporting entities

Australian Taxation Law

- AETL001 - Individual Taxation

- AETL002 - Taxation of Legal Entities

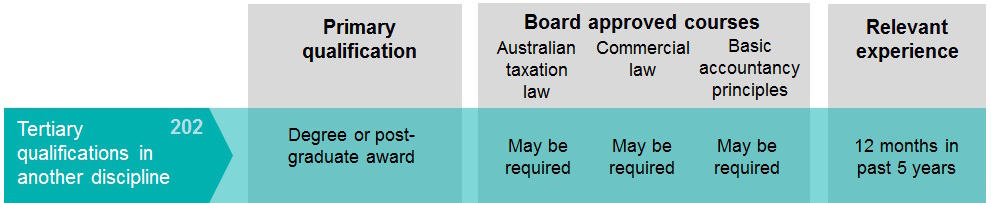

Pathway for other disciplines

If you have a degree in a discipline other than law and accounting you will need to complete our courses in:

Basic Accounting Principles approved by the board

FNSACC421 Prepare financial reports and FNSACC414 Prepare financial statements for non-reporting entities

Australian Taxation Law

- AETL001 - Individual Taxation

- AETL002 - Taxation of Legal Entities

Commercial Law

- AECL001 - Corporations and Trusts Law

- AECL002 - Property Law

- AECL003 - Contract and Consumer Law

Course in Basic Accountancy Principles

approved by the board

Australian Taxation Law

FNSSS00008 Tax Law for Tax Agents Skill Set

(Tax Documentation)

This course provides you with a detailed understanding of the concepts and application of Australian Tax Law.

Commercial Law

FNSSS00005 Commercial Law for Tax Agents Skill Set

Accounting Experts

Training experts since 1999

Tax Practitioners Board Approved

TPB approved for Tax Agent registration

Amazing Support

Expert trainers and passionate support

IFPA Membership

Developed in consultation with industry partner Institute of Financial Professionals Australia (IFPA)

Student Support - The Applied Education Difference

Amazing Support

Every student receives help getting started

and can book a welcome callOnline Support

Dedicated Support Team and Ticket Lodgement

Facebook & Student Forums

Dedicated Facebook Study Group and Online Forums

Phone Support

Talk to Assessors & Student Services Team

Accreditation & Industry Partners

As a Registered Training Organisation (ID 52240), we comply with the government’s strict quality and consistency standards. We conduct regular audits to ensure we keep this accreditation and deliver the level of training you deserve.

Nationally Recognised Training - The units in this course are recognised in all states and territories of Australia.