Becoming a Payroll Officer

If you are thinking of becoming a Payroll Officer, these are the duties you can expect to do day to day:

- New employee inductions and forms – Tax File Number declaration forms, superannuation choice form, personal details.

- Induction – Welcoming employees and ensuring they know their employee handbook, rights and responsibilities, conditions of employment.

- Processing payroll – This is the fun part, setting up your employee in your accounting software (we use Xero), ensuring correct tax details are entered, rates of pay.

- Payroll allowances. Do you employees have a work car? You might even have to prepare FBT (Fringe Benefits Tax) returns. Maintain log books. Travel allowances, telephone, tools. It’s important you know if you have to withhold PAYG on these, if you pay super on these allowances? Payroll tax?

- Salary packaging – Many employers allow employees to Salary package things like cars and laptops. You need to administer these and deduct from gross and net pay.

- Superannuation – Remit to the ATO super for employees, manage salary sacrifice superannuation. Report on payment summary at year end.

- Workcover – Every state and territory in Australia has it’s own workcover/insurance scheme for workers. You need to mange this for all your staff. You even need to know what is “deemed” an employee for workcover purposes.

- Payslips, record keeping.

- Leave entitlements – Checking awards and ensuring your employees accrue leave correctly. Checking awards if leave loading is applicable. Ensuring software is setup correctly. Checking for things like leave without pay, personal leave.

- Year-end procedures – Important bookkeeping tasks like making sure your PAYG withheld from wages is what has been paid to the ATO oat W2 on your instalments and BAS. Does this amount equal what is on the employees payment summaries?

- Tax Agent Services Act – If you plan on being a Payroll Officer as a sole trader for example, then you may need to register as a Bookkeeper with the Tax Practitioners Board. DO you have the required qualifications and experience to register? Have you registered?

- Single Touch Payroll – The ATO now require electronic lodgment of payroll details. You need to use the latest software, make sure you are setup correctly for it.

If you have a passion for Payroll then these are some of the things you might find yourself doing.

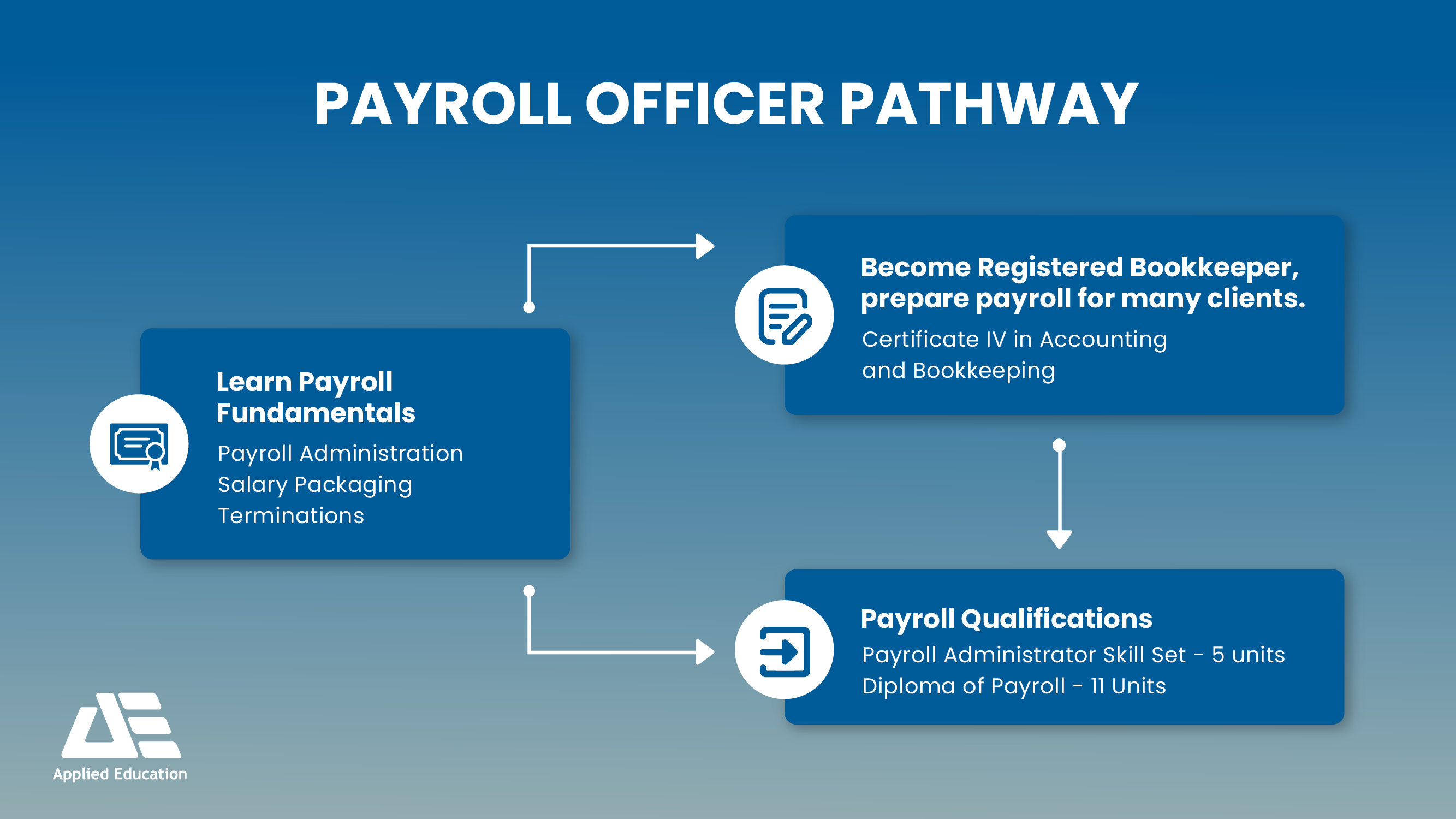

At Applied Education we cover everything from beginning your career in payroll (Payroll Administration Course, Salary Packaging Course); through to becoming a professional Bookkeeper (Certificate IV in Accounting and Bookkeeping); and acquiring a Payroll Certification (Diploma of Payroll or Payroll Administrator Skill Set).

If you are looking to re-skill or up-skill but unsure of which course best suits you, get in touch with one of our consultants today and we will endeavour to help you.