Generally, you must apply to renew your registration at least 30 days before it expires. You will remain registered until we make a decision on your application. If approved, your registration period will be renewed for at least three years. Full details of the can be found on the Tax Practitioners Board Website.

Applied Education’s 4 steps to renewing your registration.

Applied Education has hundreds of students each year asking us this question and here are our tips for renewing your registration.

Read more on Applied Education’s Tax Financial Advisers Licencing Course

Step 1 – Be a fit and proper person

In deciding whether an individual is a fit and proper person the TPB consider:

- whether the individual is of good fame, integrity and character

- whether any of the following events have occurred during the previous five years:

- the individual has been convicted of a serious taxation offence

- the individual has been convicted of an offence involving fraud or dishonesty

- the individual has been penalised for being a promoter of a tax exploitation scheme

- the individual has been penalised for implementing a scheme that has been promoted on the basis of conformity with a product ruling in a way that is materially different from that described in the product ruling

- the individual has had the status of an undischarged bankrupt

- the individual has been sentenced to a term of imprisonment, or served a term of imprisonment in whole or in part.

Step 2 – Satisfy the qualifications and relevant experience requirements which includes that you are, or have been, an Australian financial services (AFS) licensee or a representative of an AFS licensee within the 90 days preceding your application

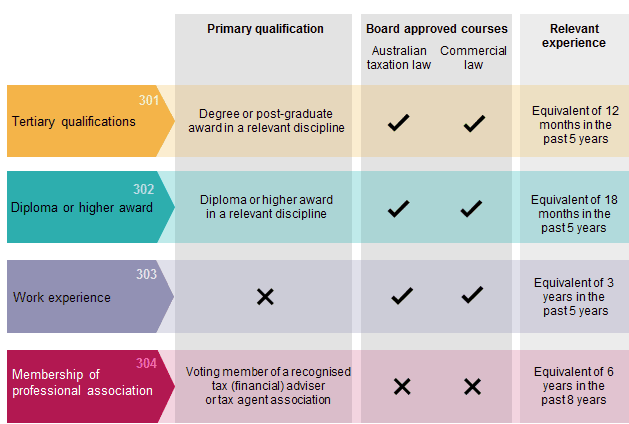

The following table summarises the requirements under these items, covering:

- Primary qualification

- Board approved courses

- Relevant experience.

Read more on Applied Education’s Tax Financial Advisers Licencing Course

Step 3 –Meet the continuing professional education requirements

When renewing your registration, you must have completed continuing professional education (CPE) that meets our requirements. The relevant experience needed will vary depending on your qualification. It can vary from twelve month up to two years.

You must complete a minimum of 60 hours of CPE within a standard three year registration period, with a minimum of seven hours each year (unless there are extenuating circumstances).

Step 4 – Complete the online renewal form

Read more on Applied Education’s Tax Financial Advisers Licencing Course