CPE BAS Agents

All Posts

Home » BAS agents, are you ready for the changes to CPE hours? From 1 July 2022, the Tax Practitioners Board (TPB) increased the CPE requirements for BAS agents and Tax Agents in Australia. These are the first changes in ten years to the TPB’s policy on CPE requirements. Do you know what these changes […]

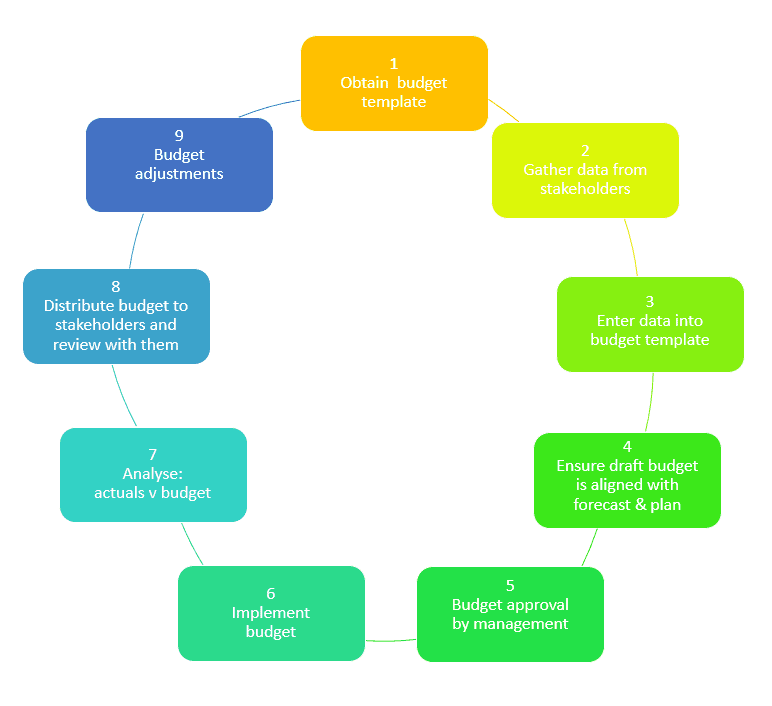

Read MoreHome » What’s the purpose of a budget? What’s the purpose of a Budget? A budget is an essential management tool for any business; it is a component of a plan and forecast for a period of time. The period could be annual, quarterly or monthly, and the budget details how the over-all plan will […]

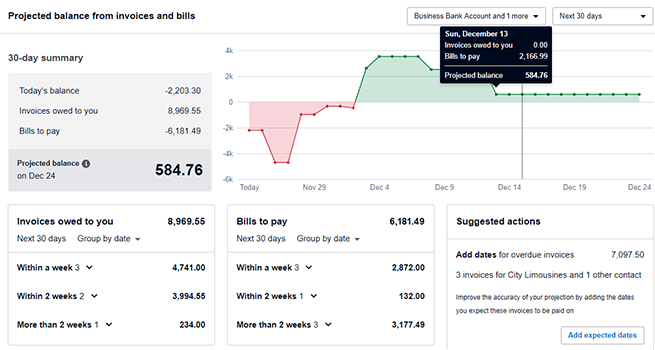

Read MoreHome » Forecasting for Bookkeepers Bookkeepers using accounting packages such as MYOB and Xero can use forecasting as a way to plan and predict futures cash flows and budgets. It can be useful for predicting issues before they arise, from simple reports forecasting accounts receivable and payable cash flow and for long term budgeting and […]

Read MoreHome » Applied Education rolls out the latest AE Live online interactive learning experience We are very excited to announce the launch of AE Live! Using the latest online interactive learning technology, Applied Education’s custom-designed web conferencing system is fully integrated with our Learning Platform. You don’t need to download an additional app or remember […]

Read MoreHome » How to Complete your Continuing Professional Education (CPE) requirements as a BAS Agent BAS Agents in Australia are required to complete a minimum number of Continuing Professional Education (CPE) hours each year in order to maintain their registration. CPE for BAS Agents How many hours do I need? What qualifies as CPE? How […]

Read More