Government Funding Available

Course fees only $740 for concession or $2083 for non-concession!

Tax Agent or Commercial Accounting Course

FNS60222 Advanced Diploma of Accounting is our highest level qualification. It is ideal for individuals who are working in accounting and wishing to advance their career, including commercial accounting, business analysis and as a tax agent. The Advanced Diploma of Accounting covers theoretical and technical skills in a range of complex operations, and may offer a pathway to university studies.

This course meet the education requirements for tax agent registration with the Tax Practitioners Board and includes Student membership with the Tax and Super Australia.

Get the course guide!

"Am I ready to study checklist?" included

SA Government Funding For Eligible Trainees

Online Learning

Instant Access

Nationally Recognised

If you have completed FNS50222 Diploma in Accounting

Great, you can apply for a credit transfer towards the Advanced Diploma of Accounting.

Meet the TPB education requirements for Tax Agents

Dedicated support

$2082.50 for non-concession

$739.50 for concession

RRP $2990 for 9 units

Eligibility

You must meet the following

- Live or work in South Australia;

- Australian or New Zealand citizen, or an Australian Permanent Resident or an eligible visa holder

- be aged 16 years or older; and

- not enrolled in school

- have an employer willing to offer you a traineeship

See below for full details *

Benefits of a Traineeship

- Reduced course fee.

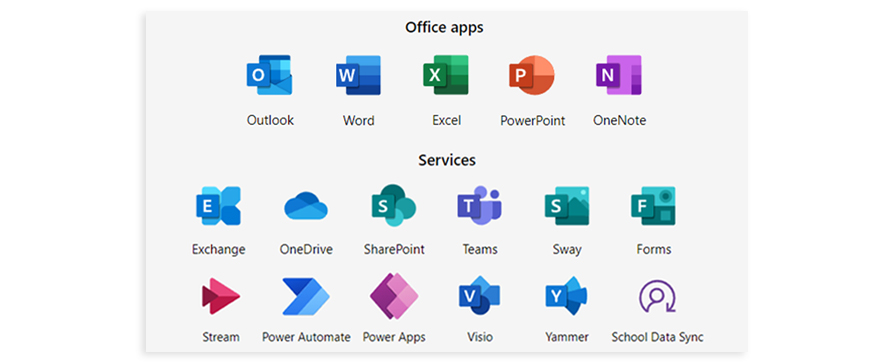

- Amazing support; one-on-one support via Microsoft Teams with a qualified Trainer/Assessor.

- Attain a Nationally Recognised qualification.

- Plan for your future and help your employer develop the skills of their workforce

Not sure which course is right for you? Completed prior units and may be eligible for credits? Call us on 1800 678 073 for a consultation with a course coordinator.

Bookkeeping Experts

Training experts since 1999

Tax Practitioners Board Approved

TPB approved for BAS Agent registration

Amazing Support

Expert trainers and passionate support

Online Video Tutorials

Hundreds of tutorials covering key learning concepts

Student Membership Included

Institute of Financial Professionals Australia

Applied Education has partnered with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) to provide you with the tools and resources you need to thrive in your study and professional career.

Tax students* at Applied Education receive, at no additional cost, a 12-month Student Membership with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia). This membership is specifically designed to help you complete your study and prepare you for your future career as a Tax Professional with one of Australia's leading Tax Associations.

*This offer is available if you enrol in the Tax Agent Registration Course, Diploma of Accounting with tax electives or Advanced Diploma of Accounting. Key benefits to this membership include:

For information on the full range of benefits of this Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) membership, click here.

Student Support - The Applied Education Difference

Amazing Support

Every student receives help getting started

and can book a welcome callOnline Support

Dedicated Support Team and Ticket Lodgement

Facebook & Student Forums

Dedicated Facebook Study Group and Online Forums

Phone Support

Talk to Assessors & Student Services Team

Accreditation & Industry Partners

As a Registered Training Organisation (ID 52240), we comply with the government’s strict quality and consistency standards. We conduct regular audits to ensure we keep this accreditation and deliver the level of training you deserve.

Nationally Recognised Training - FNS60222 Advanced Diploma of Accounting is recognised in all states and territories of Australia.