Budgetary control is a system of procedures used to ensure that an organisations income and expenses align with the financial plan.

Budgetary Control

A Step-by-Step Guide to Budgetary Control

The system of budgetary control involves the below key principles:

- Setting standards to coordinate and control the budget process (policies and procedures).

- Recording and measuring current financial performance (preparing budgets).

- Making comparisons between actual and budgeted results (variance analysis).

- Taking appropriate corrective action as required.

At the very least, it requires budgeted estimates to be compared with actual performance achieved during the budgeted period and for variances to be analysed and corrections made.

Best business practice suggests that businesses should standardise their budgeting calculations, display formats and review periods to allow key financial ratio’s to be easily and accurately, calculated and compared.

Policies and Procedures

Policies and procedures must be put in place for creating a realistic budget that will allow a business to predict the financial standing of the business.

Key Features of Budgetary Policies and Procedures

The following components must be part of the policies and procedures for budgeting:

Budget formulation - Requires the business to:

- Use Historical data to reflect on the past.

- Prepare forecasts to set goals for the future.

- Prepare a mode for measurement (budgets).

- Reconcile the difference (variance analysis).

- Take corrective action.

Budget Approval

Specify the person/s approving the budget and the conditions required for approval.

Budget execution

Specify how the financial resources are to be made available in order to meet budget objectives.

Common Policies and Procedures

Policies and procedures will vary from business to business. Some other common requirements are:

- Setting up a business bank account: A business owner must set up a bank account for the business, separate from their own personal account.

This will assist them in easily monitoring the income and expenses of the business. - Creating a budget: Policies and procedures must be put in place for creating a realistic budget for any business activity.

Setting up a realistic budget allows you to predict the financial standing of the business. - Establishing an accounting system: A cash accrual system or cash-accounting system must be established to allow the business to review and manage their financial activities, and to comply with their financial obligations.

- The financial statements of the business (e.g. balance sheets, profit, and loss statement) must regularly be reviewed to identify any errors that can possibly occur in the future.

- Procedures for providing credit and collecting outstanding debts: The business must ensure that they have a good cash flow and minimal exposure to debt.

(Source: Developing financial processes and procedures, 2016)

Other Items That May Be Included

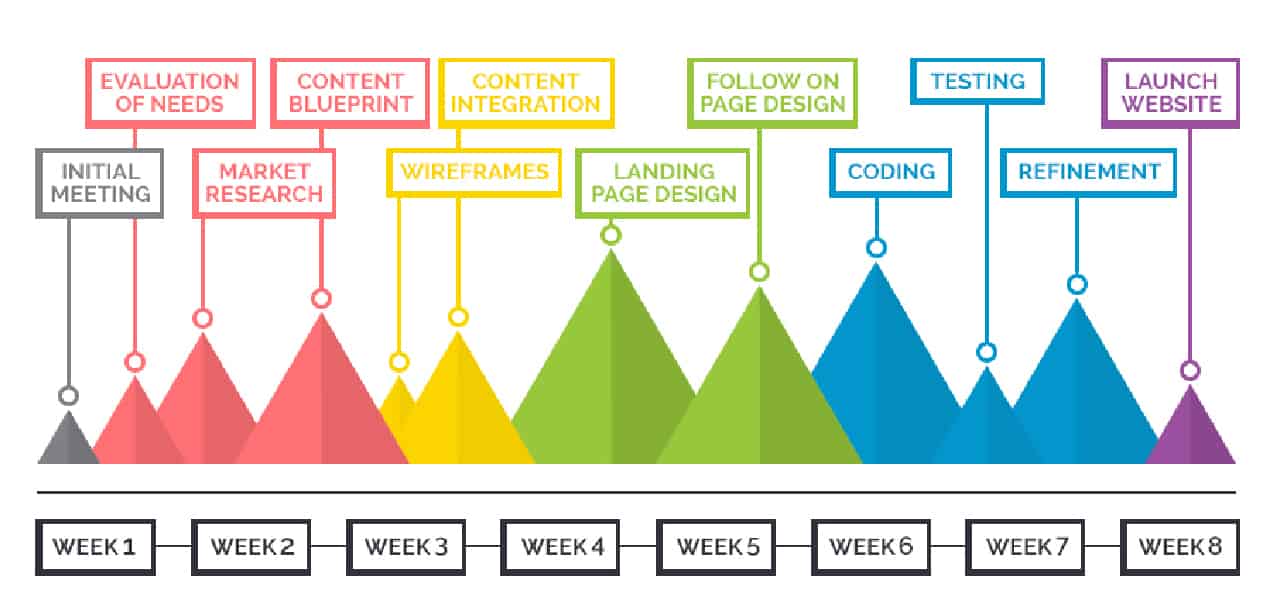

Timeliness and Milestones are often included as part of the budget formulation and may include items such as:

- All levels of budgets need to be prepared and reviewed monthly, quarterly and annually.

- Budgets must be finalised prior to one month of the budgeted period.

- Variance reports must be sent to relevant managers within 2 working days of the end of the reporting period.

- Variances must be addressed and returned to the finance department within 3 working days.

- Flexible budgets must be updated prior to the end of the next reporting period.

- Key milestones for projects to be formally recorded and reviewed.

Key Performance Indicators are usually specified as part of the budget formulation and may include items such as:

- Sales to grow by x% per year with an allowable deviation of x%.

- Gross profit should be approximately x with an allowable deviation of x%.

- Net profit to be x$ per (insert period) with an allowable deviation of x%.

- Product mark-up should be x% with an allowable deviation of x%.

- Sales budget to be prepared at product detail level.

- x% of unallocated stock to be kept on hand to meet short term customer needs.

Release Of The Budget

Once a budget has been approved and released there should be efficient systems and processes in place to achieve the budget goals. This will include:

- Monitoring and reporting back to management.

- Implementing control procedures.

- Making evaluations and taking appropriate remedial action to rectify deviations.

Performance Indicators

Milestones and Key Performance Indicators (KPI’s) are both measures of performance and significant objectives. Milestones and KPI’s work together:

- Milestones provide goals and timeframes. These are particularly useful when working on project budgets as there will be many different deadlines.

- KPI’s provide quantifiable measures to determine performance (which can be quantitative or qualitative)

Milestones

A budget is not a real plan without milestones.

Milestones turn tactics into practical, concrete terms with real budgets, deadlines, review and responsibilities.

Without review, there is no management and no accountability. Just as tactics are needed to execute strategy, so too are milestones required to achieve tactics.

A milestone is a point in time when a particular action has reached a crucial stage that indicates it’s progressing as planned. Action timelines and their milestones are best guesses (hopefully informed theories) about what’s going to improve business performance. Milestones also need measures to test if they’re working or not (KPI’s provide the means for measurement).

Completing a task or activity, such as reaching a milestone, does not represent performance. If milestones were used as measures, it could drive the wrong behaviour (people fiddling with the timeline, rather than making sure the action is making the improvements in business performance it was designed to).

Some examples of milestones or performance indicators in the budgeting context might be compliance with scheduled payment dates, meeting of debt reduction targets or meeting of certain unit costs.

Key Performance Indicators

Key performance indicators are quantifiable measures used to help a business define and measure progress towards achieving its objectives.

Measures can be expressed in financial or non-financial terms.

Where possible, performance indicators should meet the SMART criteria

Specific, Measurable, Actionable, Realistic and Timely.

There is a multitude of internal and external factors affecting the performance of every business.

The sheer volume of information available to management can be a distraction, so managers need to focus on a handful of key indicators which:

- Assess the performance and progress of a business

- Are measurable

- Can be compared to a standard, such as a budget or last year’s figures

- Can be acted upon

Examples of key performance indicators relating to budgets include:

Sales quantity or revenue

The Sales Manager may be given a measurable outcome of achieving 10% growth on sales quantity or revenue each year.

It may also specify how they want the growth to occur eg 2 new clients to be included in the 10% growth or when they want the growth to occur eg the Summer Season to increase by 7% and the Winter Season to increase by 3%.

Budget variance – income & expense

KPI’s may specify specific variance deviations between budgeted and actual results eg acceptable deviations are - sales 10%, fixed expenses 5% and variable expenses 8%.

Budget variance – profit

KPI may specify a specific gross profit target, a mark-up % or net profit target.

Return on investment

Show’s a project’s profitability and whether the benefits have exceeded the costs.

Market share percentage

Generally sales measured as a percentage of industry’s total revenues.

Product quality

This may be set at the number of complaints received in a period or the number of faulty items returned.It may also be a measure set against the cost of providing Quality Control staff at production facilities.

Schedule adjustments

The number of times your team has made adjustments to the completion date of the project as a whole.

Performance Driver Examples

To boost profitability and cash flow a business also needs to understand and monitor the key ‘drivers’ of a business.

A driver is something which has a major impact on the performance of the business.

For example, monitoring sales will not necessarily help improve sales performance.

Examples of some performance drives are below:

- After a period of stability and high profits, a specialist travel agency realised that staff turnover was a driver.

An experienced sales person was found to be three times more productive than a new recruit.

The recruitment and training process for new salespeople was a major burden.

To reduce staff turnover, the travel agency introduced a long-term incentive element into remuneration packages. It also launched quarterly performance reviews. - An engineering company found that the product defect ratio was a driver.

Defects led to goods being returned, extra work to rectify the faults, delays in payment, and lower prices being achieved.

The company reorganised the workforce to work in ‘quality cells’ and stopped using a machine which was unreliable.

Productivity increased significantly.

If you are looking to re-skill or up-skill but unsure of which course best suits you, get in touch with one of our consultants today and we will endeavour to help you.