Bookkeeping & BAS

All Posts

Home » Applied Education rolls out the latest AE Live online interactive learning experience We are very excited to announce the launch of AE Live! Using the latest online interactive learning technology, Applied Education’s custom-designed web conferencing system is fully integrated with our Learning Platform. You don’t need to download an additional app or remember […]

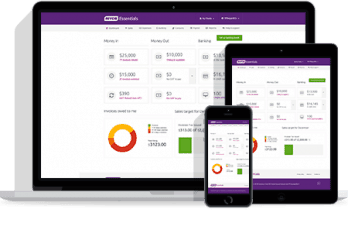

Home » What Cloud Accounting Software Should I Learn? There are many cloud accounting options that bookkeepers and small business owners can consider, including MYOB Essentials. MYOB Essentials is designed for small businesses yet incorporates advanced features including comprehensive reports, bank feeds and task automation. What are the benefits of using cloud accounting versus […]

Home » What are the Government’s COVID-19 cash flow boosts for your business? It seems the Total time, Estimated cost, Country ISO code, Supply, Tools fields are empty.It may generate Schema errors / warnings for your Page, we recommend you to fill those fields. What are the Government’s COVID-19 cash flow boosts for your business? […]

Home » Bookkeepers are you up to date on all ATO changes that came into effect last year? The ATO introduced a number of legislative changes last year that will impact many small business. Here is a quick summary of the areas that may affect your business or your clients. Payments to contractors The Taxable […]

Home » AUSkey is ending soon BAS and Tax Agents still using AUSKey need to update now. At the end of March 2020, the AUSkey system for reporting to the ATO will no longer be available. From 1 April 2020, BAS and Tax Agents will need to use myGovID and Relationship Authorisation Manager (RAM) instead. […]

Home » Is the work Christmas party subject to Fringe Benefits Tax? Christmas parties are a great way to thank staff and clients for their time and support over the year. If you are hosting a function for your clients that require your staff to attend, remind your staff that this is a work commitment, […]