NEW YEAR, NEW START

SAVE 5% on course fees. Offer ends 31 Jan 2026!

TPB approved online courses in Australian Taxation Law and Commercial Law for Tax Agent Certification

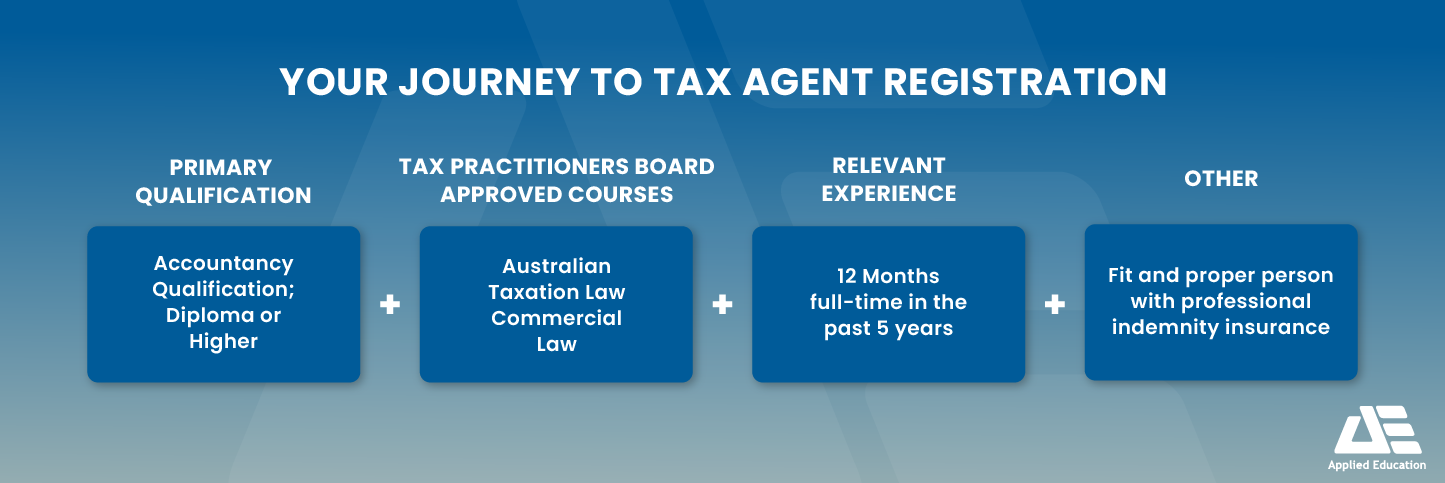

Want to become a tax agent and already have a diploma or degree in accounting?

These online courses are ideal for those with a primary financial qualification, or accountants with international qualifications, who need to study additional units to meet the education requirements of the Tax Practitioners Board (TPB) to become a tax agent.

The tax agent certification course is nationally recognised and covers the relevant Skill Sets as approved by the TPB. Other conditions apply – please refer to Education Requirements for Tax Agents

We also include comprehensive lectures that provide a high-level overview of taxation and law concepts, and are delivered by our expert trainers who also have extensive accounting industry experience.

Free Tax Agent course guide!

"Am I ready to study checklist?" included

LG TPB TAX Agent

Tax Agent Pathway Course Options

FNSSS00005 Commercial Law for Tax Agents Skill Set

FNSSS00008 Tax Law for Tax Agents Skill Set

Study by the Unit for Tax Agent Registration

Choose your Units

from $707 RRP $745 for 1 unit

or 2 units $631 each RRP $665 each

or 3 to 4 units $584 each RRP $615 each

Instant Access

Dedicated support - Bonus upskill courses

Australian Tax & Commercial Law for Tax Agents

Enrol in all 5 units (Commercial Law and Tax Law)

only$2490

RRP $2625

Instant Access

Dedicated support - Bonus upskill courses

🎓 Not sure which course is right for you? Let’s find your fastest path!

If you’ve completed prior study, you could earn credits towards your qualification.

Call 1800 678 073 or book a FREE enrolment consultation with a course advisor today and get expert advice.

Recorded Lectures and Tutorials

7 to 22 hours of online lectures and tutorials per unit

Tax Practitioners Board Approved

TPB approved for Tax Agent registration

Amazing Support

Expert trainers and passionate support

Tax and Super Membership

12-month student membership with Tax and Super Australia

Course Content

Enrol in only the Tax units you need for TPB tax agent registration & certification

Australian Taxation Law

FNSSS00008 Tax Law for Tax Agents Skill Set

(Tax Documentation)

This course provides you with a detailed understanding of the concepts and application of Australian Tax Law.

Commercial Law

FNSSS00005 Commercial Law for Tax Agents Skill Set

Course in Basic Accountancy Principles

approved by the Board

NEW: Lecture Recordings Included

Student Membership Included

Institute of Financial Professionals Australia

Applied Education has partnered with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) to provide you with the tools and resources you need to thrive in your study and professional career.

Tax students* at Applied Education receive, at no additional cost, a 12-month Student Membership with the Institute of Financial Professionals Australia (formerly known as Tax & Super Australia). This membership is specifically designed to help you complete your study and prepare you for your future career as a Tax Professional with one of Australia's leading Tax Associations.

*This offer is available if you enrol in the Tax Agent Registration Course, Diploma of Accounting with tax electives or Advanced Diploma of Accounting. Key benefits to this membership include:

For information on the full range of benefits of this Institute of Financial Professionals Australia (formerly known as Tax & Super Australia) membership, click here.

Free Short Course Bundle Included

Choose 1 FREE Fundamentals bundle or 2 for $295, or all 3 for $495 when you enrol.

Perfect to meet CPE/CPD requirements and upskill

* If you are applying for funding for this course, there may be restrictions on Free Bundles depending on government funding eligibility requirements.

Student Support - The Applied Education Difference

Amazing Support

Every student receives help getting started

and can book a welcome callOnline Support

Dedicated Support Team and Ticket Lodgement

Facebook & Student Forums

Dedicated Facebook Study Group and Online Forums

Phone Support

Talk to Assessors & Student Services Team

Accreditation & Industry Partners

As a Registered Training Organisation (ID 52240), we comply with the government’s strict quality and consistency standards. We conduct regular audits to ensure we keep this accreditation and deliver the level of training you deserve.

Nationally Recognised Training - FNSSS00005 Commercial Law for Tax Agents Skill Set (Release status: current) and FNSSS00008 Tax Law for Tax Agents Skill Set (Release status: current) are recognised in all states and territories of Australia.

Comments are closed.