To become a registered individual tax agent, or to renew your registration as an individual tax agent, you must satisfy certain qualifications and experience requirements, which are set out in the Tax Agent Services Regulations 2009 (TASR).

Qualifications and experience requirements for tax agents

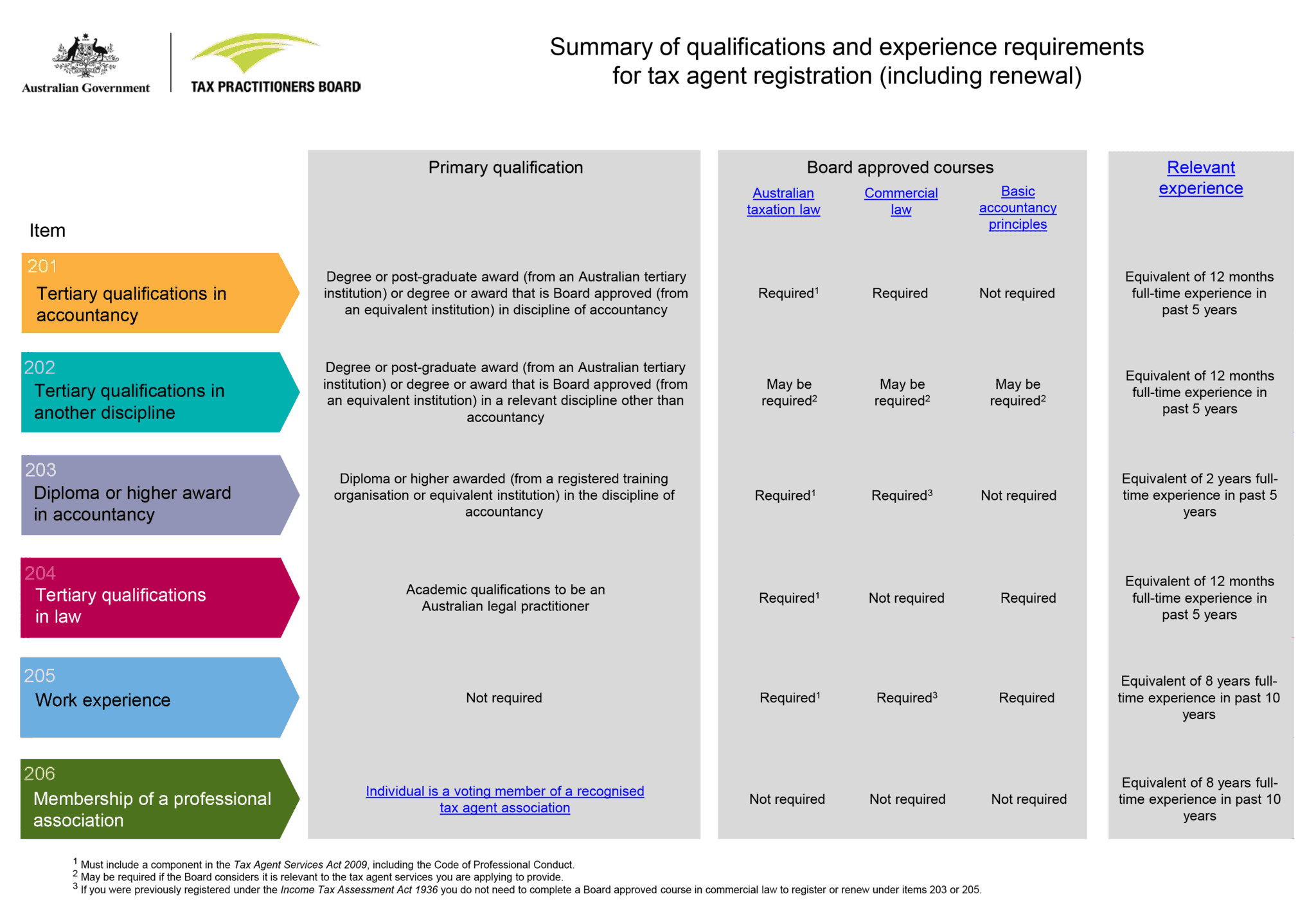

The Summary of qualifications and experience requirements for registration (including renewal) as a tax agent table below outlines the qualifications and experience options for individuals seeking registration, including renewal of registration, as a tax agent. You must satisfy the requirements under one of the six items (items 201 to 206) in the table.

Each of the six items broadly consists of the following components:

- Primary qualification

- Board-approved courses

- Relevant experience

Primary qualification

Each of the six items, except for item 205 (work experience), contains a qualification called the primary qualification.

You should select the item containing the most suitable primary qualification. As a general guide, if you:

- Have a qualification in accounting, you may find items 201 or 203 most suitable

- Have a qualification in a discipline other than accounting, you may find item 202 most suitable

- Have a qualification in law, you may find item 204 most suitable

- Do not have one of the above qualifications, but have at least eight years of relevant experience in the past 10 years, you may find items 205 or 206 most suitable.

Board-approved courses

Depending on which of the six items (items 201 to 206) you are seeking to rely on, you may need to have completed one or more of the following Board-approved courses:

• Australian taxation law

• Commercial law

• Basic accountancy principles

Relevant experience

If you are applying to register as an individual tax agent, you will need to have sufficient relevant experience in providing tax agent services.

Courses to assist in your tax agent qualification

Applied Education is a TPB-approved education provider. We have education options available for those needing a primary accounting qualification and/or board approved courses.

Need advice?

Not sure what requirements you need to meet in order to become a Tax Agent?

Give us a call to speak to one of our course advisers.

Call – 1800 678 073 or (08) 9221 0955