What's the purpose of a Budget?

A budget is an essential management tool for any business; it is a component of a plan and forecast for a period of time. The period could be annual, quarterly or monthly, and the budget details how the overall plan will be financially executed. Budget control can greatly assist with the daily operation and future growth of a business.

Table of Contents

Benefits of Budgeting

Budgeting provides a systematic way of reviewing estimated with actual results, coordinating future activities and setting realistic targets. It is an effective management tool and its benefits include:

- Provides a time frame required to control finances.

- Highlights cashflow shortages/financing requirements etc.

- Provides the basis for taking corrective action if budgeted figures do not match actuals.

- Variance analysis/financial ratios/investigation to make changes in the budget.

- Provides a set of standards for performance evaluation.

- Plans are carried out by people, and budgets provide benchmarks that management can use to evaluate the performance of those responsible for carrying out those plans.

- Roles of staff members are defined and understood.

- Transparency builds good relationships and develops morale in the workplace.

- Develops a system to provide feedback on performance.

Limitations of Budgets

The main limitations of budgeting are as follows:

- The budget is only as good as the assumptions or estimates on which it has been based. There is always uncertainty when predicting future events, and the quality of the estimates will be critical to the use of the budget.

- The budget process may be expensive initially and during its operation with respect to both monetary costs and staff time. Management will need to monitor the situation to ensure the benefits exceed the costs of installing a budgetary system.

- Preparation of the budget is no guarantee of success. Other factors include the performance of staff members and management, and the operating and economic environment.

- The budget must be delivered in a timely manner to the relevant people in order for appropriate action to be taken.

- Variances between budget and actual figures need to be identified and addressed, and improvements implemented in a timely manner. (Source: Clowes & Scrivan, 2011, pp.6-7)

Timeliness of Budgets

Budget and forecast reports must always be developed, completed and communicated well before the period to which they relate.

This is important to ensure that stakeholders have a reasonable opportunity to consider the information provided in the reports and make any decisions as a result of the reports on a timely basis.

Budgeting period

There are no strict rules in determining the length of a budget period. As a general rule, it should be long enough to show the effect of management policies yet short enough so that estimates can be made with reasonable accuracy.

Regular review

It is not good enough to set and forget your budget. Reviewing actual results against budgeted estimates on a regular basis allows the manager to be confident that they are in control and on track to achieving the planned position.

The frequency of budget monitoring may be specified in the Budget Policies and Procedures.

Typical review period

It is common for budgets to be reviewed:

- On a monthly basis, and

- At the end of each quarter, and

- At the end of the financial year

- Cash budgets are usually performed more frequently (daily/weekly).

Depending on the industry, budgets may also be reviewed:

- At set stages during a project, or

- At the end of a season.

The advancement in better-performing computer systems is enabling performance to be reviewed more regularly. In some instances, reviews and comparisons are able to be performed on-demand and in close proximity to real-time results.

Rolling on a continuous basis

Some budgets are prepared on a rolling or a continuous basis. This means they are continually updated so that it will always reflect plans for the same length of time, e.g. six (6) weeks. With rolling budgets, a new time period e.g. a month or quarter is added, and the corresponding period just completed drops off. A cashflow budget is often prepared in this manner.

Longer range budget

A capital expense budget is often a longer-range budget as it details the business's plans to acquire plant and equipment over a long period of time such as 10 years, or even longer.

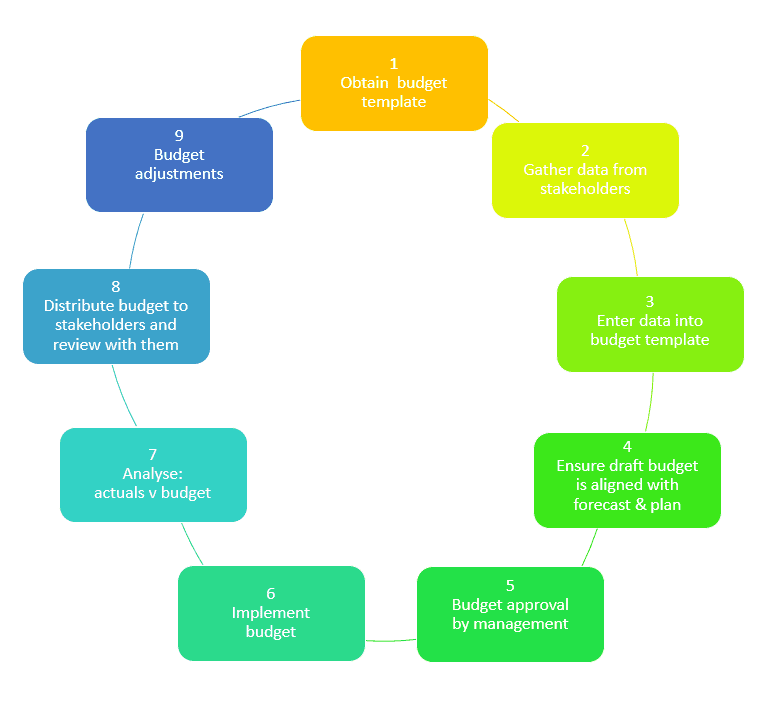

Budgeting process overview

A budget will generally include estimated sales and expenses, and their associated cashflows for a future period. Estimates are usually calculated per month with a year-to-date total. Budgets are compared with actual results at the end of a period. Variances are analysed and investigated.

There are many different types of budgets which will be discussed further in this manual. Formats and the level of detail included in budgets can vary between organisations.

Want to learn more?

If you want to learn more about budgeting concepts, you can take a short course for quick learning or enrol in a recognised qualification.

If you are looking to re-skill or up-skill but unsure of which course best suits you, get in touch with one of our consultants today and we will endeavour to help you.