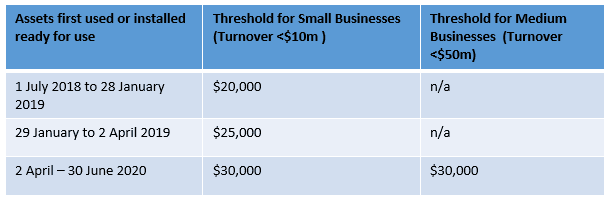

Legislation passed at the start of this month, regarding the instant asset write-off for small and medium sized businesses with a turn-over of less than $50million.

There are now three tiers of threshold that bookkeepers, accountants and tax agents need to be aware of for this financial year and next.

Thresholds

While these new and extended thresholds aim to provide a boost to business activity, investment and growth, they are complex and you will need to fully understand the thresholds to get it right.

Tips

1) Ensure that the correct dates of purchase are recorded and the date it was installed ready-for-use.

2) Bookkeepers will need to work closely with their tax agents to determine the most appropriate option to claim depreciation for the business:

– Immediate write off the asset in accordance with the policies of the tax agent; OR

– Correctly coded as a fixed asset with the intention to depreciate at the end of the financial year by the tax agent.

– Written off immediately by the fixed asset software.

3) Not all businesses will elect to use these simplified depreciation rules.