Other

All Posts

Home » How To Avoid Errors When Managing Payroll Tax In Australia Published: February 2024 Dealing with payroll tax in Australia can be technical because thresholds and exemptions vary in each state. To prevent inaccuracies, it is important to be mindful of the following issues: Content Incorrect calculation of the taxable wage threshold Failure to […]

Read MoreHome » 4 Steps for BAS Agent Registration Published: Jan 2023 Becoming a BAS Agent (Business Activity Statement) is a great way to start a career in accounting and bookkeeping. These professionals are responsible for preparing and lodging Business Activity Statements (BAS) on behalf of their clients, which are used to report and pay GST, […]

Read MoreHome » How to Start Your Tax Career in Australia A career as a tax agent in Australia involves providing advice, assistance and tax preparation to individuals and businesses on a wide range of tax related matters. This can include financial reporting, preparing and lodging tax returns, providing advice on tax planning and compliance, and […]

Read MoreHome » Upcoming and Proposed Changes to Superannuation Are your bookkeeping systems ready for the next changes to superannuation? Upcoming and Proposed Changes to Super Superannuation Payment Increases Threshold Changes Learn More Superannuation Payment Increases On 1 July 2021 the Superanuation Guarantee contributions by employers increases from 9.5% to 10%. Depending on the software that […]

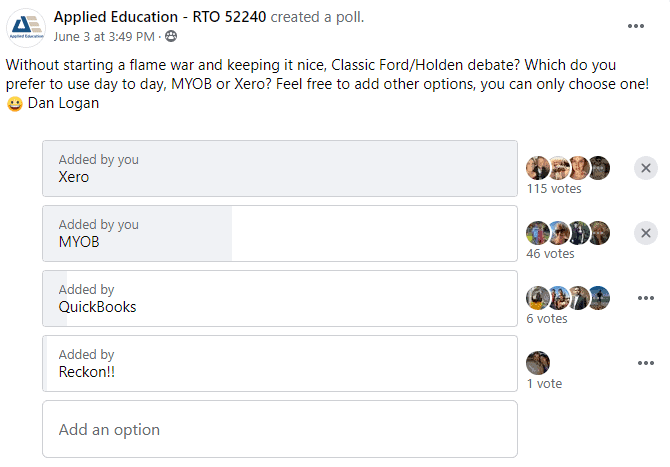

Read MoreHome » Xero or MYOB? Bookkeepers and Students tell us which one they prefer! We asked our 3000 members of the Applied Education Bookkeeping Facebook Group if they preferred MYOB or Xero to use day-to-day. The results were surprising. Xero was the preferred option with 115 votes, compared to MYOB with 46 votes. We still […]

Read MoreHome » What is Fringe Benefits Tax (FBT) and how is FBT calculated? What is Fringe Benefits Tax (FBT) and how is FBT calculated? Fringe benefits tax was introduced in legislation in 1986; prior to this businesses were providing things like cars, corporate boxes and lunches tax-free to employees, their families and executives with very […]

Read More- « Previous

- 1

- 2

- 3

- 4

- Next »