Seeing is believing

It is a known fact that the human brain is able to process graphical information far more efficiently than text. […]

Read More5 questions to ask your training provider before enrolling

Here at Applied Education we help hundreds of students navigate the minefield which is accounting training and we have found […]

Read MoreNavigating a new career path in bookkeeping or accounting

Embarking on a new career path when you are either just starting out in working life or changing careers, it […]

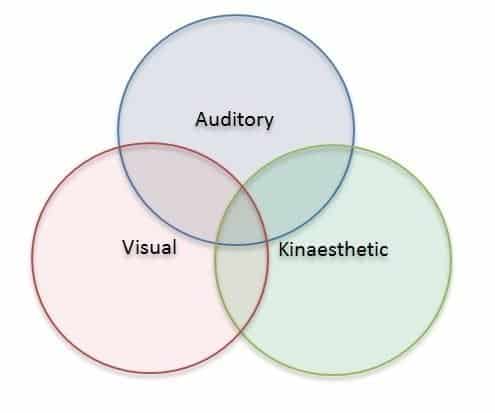

Read MoreWhat is your learning style?

It is well understood that that every person has a preferred learning style. The core learning styles are • Auditory […]

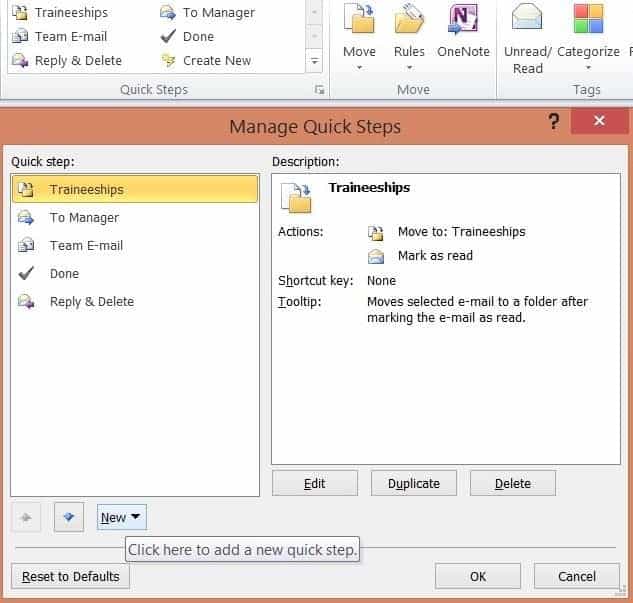

Read MoreHandy Microsoft Office Tips

It is a very common occurrence for users of Microsoft Office to make use of a very small percentage of […]

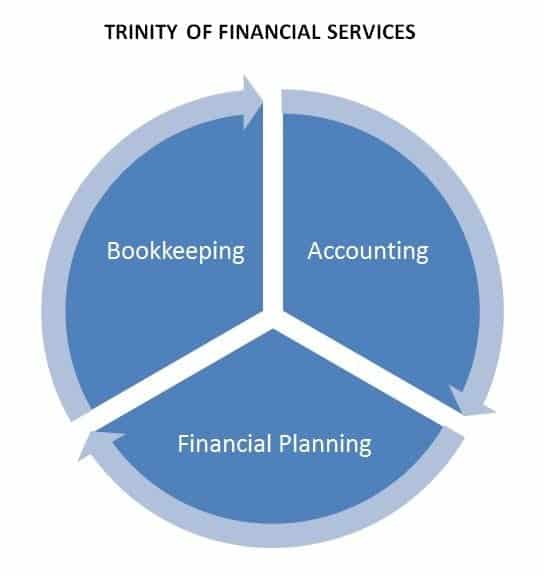

Read MoreThe many different faces of bookkeeping

For the uninitiated, there is a perception that working as a bookkeeper is a very homogenous role with few options […]

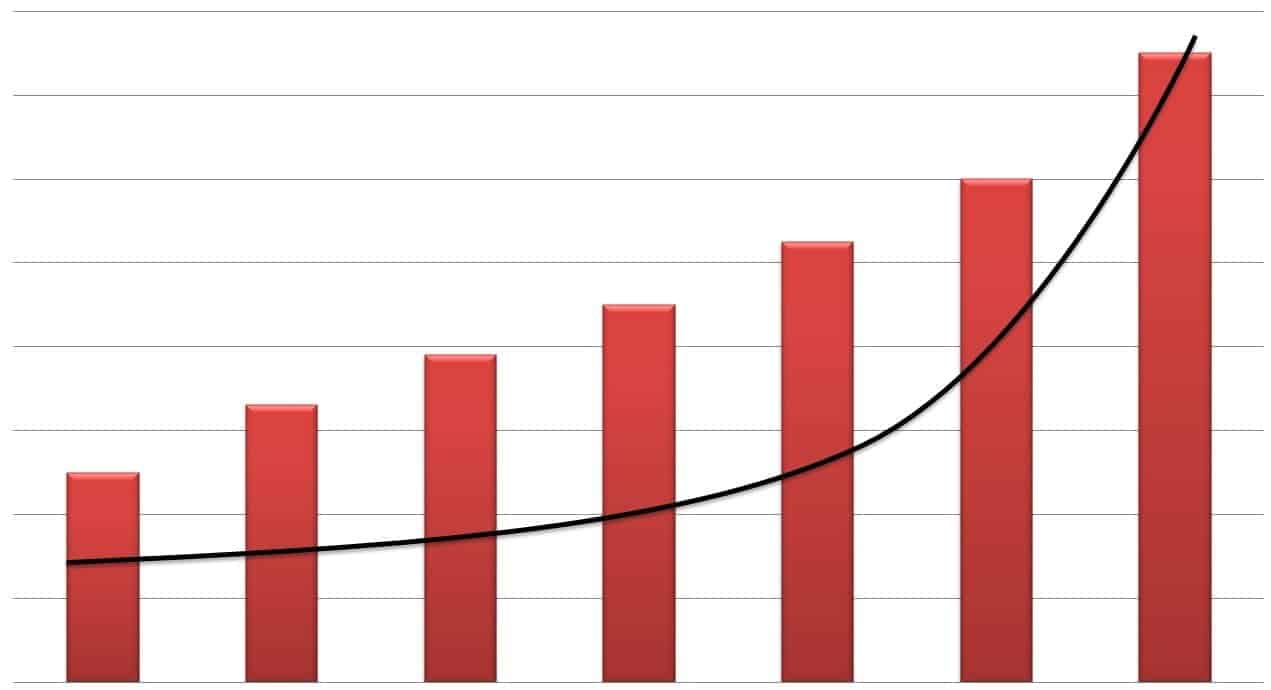

Read MoreBookkeeping and accounting among top-trending jobs

As you undertake your studies in bookkeeping and accounting, have you ever wondered what the fastest-growing accounting and bookkeeping jobs […]

Read MoreChanges to Superannuation Guarantee and instant asset write off for small business

The Palmer United Party senators have agreed to pass the Mining Tax Repeal Bill (now called Minerals Resource Rent Tax […]

Read MoreDirector Penalty Notices

Company directors have a legal responsibility to ensure that their company meets its pay as you go (PAYG) withholding and superannuation […]

Read MoreEmployees take the ‘sickie’ to a new level

According to a recent study by CareerBuilder, in 2013 alone, a whopping 32 per cent of workers called in sick when they […]

Read MoreMySuper replaces your default superannuation fund

From 1 January 2014, employers need to make super contributions to a fund that offers a MySuper product for employees who […]

Read MoreChristmas shutdowns and Christmas parties

Shutting down your business over Christmas Before you decide to shut down your business, you need to check that there […]

Read More