How do I start a career in accounting?

So you have an analytical mind, are organised, are attentive to detail, love working with people and numbers, and would like to know how to become an accounting professional.

A career in accounting can be a rewarding journey, offering diverse opportunities in various sectors.

As with any career, there are many pathway options to choose from depending on your budget, time available and your career destination.

With the demand for accounting professionals on the rise, projections indicating significant job growth in the coming years, we outline several options when choosing a pathway for your accounting career plan.

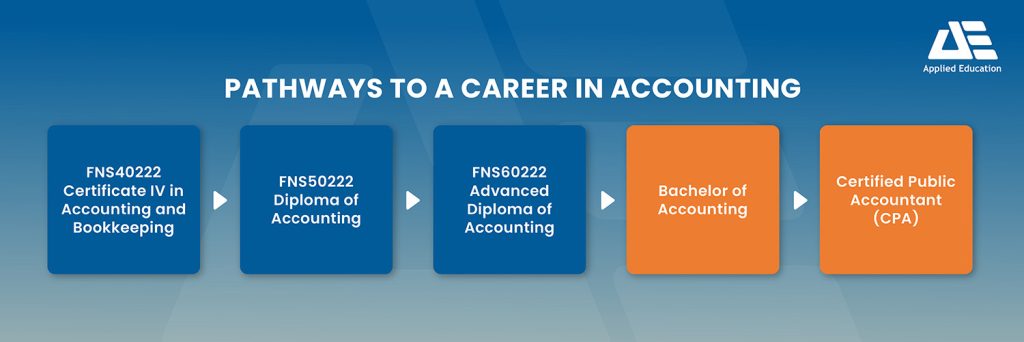

Pathway options to a Career in Accounting

The pathway from foundational education, such as a Certificate IV in Accounting and Bookkeeping, progressing to higher qualifications like a Diploma and Advanced Diploma in Accounting equips student with the necessary skills and knowledge to thrive in the accounting profession with also being job-ready after completing their first qualification.

The advantages of studying vocational (VET) courses, as opposed to university, is that you can achieve nationally recognised qualifications in shorter and cheaper timeframes. You can then add to these qualifications to progress your career at a pace that suits you and your circumstances.

1. An excellent starting place, FNS40222 Certificate IV in Accounting and Bookkeeping

There are no academic entry requirements, for this comprehensive course that will provide you with the knowledge and skills needed to conduct daily bookkeeping, payroll and accounting tasks.

The course is nationally recognised and and contains units that are approved by the Tax Practitioners Board (TPB). Once you have achieved the Certificate IV, you're eligible to work in a variety of roles including:

- Registered BAS Agent

- Company Bookkeeper

- Freelance Bookkeeper

- Small Business Owner

- Finance Manager

- Payroll Officer

- Accounts Receivable and Accounting Payable Officer

- Bank Officer

- Settlement Clerk

- Accounts Financial Officer

2. Stepping up, FNS50222 Diploma of Accounting

So you know and love this industry, and you want to advance your career as an accounting professional with a Diploma or Advanced Diploma.

FNS50222 Diploma of Accounting, is the minimum qualification to become a registered tax agent and the next step in your career.

The Diploma is designed for those with existing knowledge and qualification in bookkeeping, and there are entry requirements which are achieved through completing either the Certificate IV in Accounting and Bookkeeping or FNSSS00014 Accounting Principles Skill Set.

If you don't have a prior qualification and wish to study the Diploma, we can enrol you in the 4 entry units so you can fast-track to FNS50222 Diploma of Accounting.

The Diploma is ideal for those wanting to work as a senior bookkeeper or accountant. Applied Education offers two course choices depending on your career pathway. You can choose to study units that are relevant to commercial accounting or units relevant to taxation accounting and are approved by the Tax Practitioners Board for Tax Agent registration. On successful completion of this qualification, you can work as:

- Bookkeeper

- Tax Agent

- Finance Manager

- Payroll Officer

- Accountant

- Auditor

- Tax Specialist

3. Your pathway to an Advanced Diploma and beyond

The FNS60222 Advanced Diploma of Accounting, the highest vocational qualification, is designed for senior accounting roles and professionals, including managers and analysts.

At this level, students are expected to apply theoretical and technical skills in a range of situations. This qualification also meets the education requirements to become a registered tax agent in Australia.

The entry requirements for this course are FNS50222 Diploma of Accounting or equivalent. Careers with the Advanced Diploma of Accounting typically include:

- Tax Agent

- Senior Accountants

- Auditor

- Tax Specialist

- Commercial Accountant

4. University and other pathways

Nowadays universities offer flexible pathway entry options, including VET entry, to undergraduate studies. Depending on the university and course, a Certificate 4 qualification or higher can be used for VET entry and may be eligible for credit points.

Many of Applied Education's alumni have gone on to enrol in bachelor degrees in commerce and/or accounting after completing a diploma or advanced diploma of accounting.

With a diploma of accounting and an advanced diploma of accounting, are you eligible to become an associate member of the Institute of Public Accountants (IPA) and the Institute of Financial Professionals Australia (IFPA).

Congratulations you've choosing to work in a growing industry!

According to the Australian Government's Labour Insight Report, the projected job growth for accountants in Australia to 2026 is 9.2%.

Still unsure and want to understand the differences between accounting and bookkeeping, don't hesitate to contact us now. Our helpful team will help you choose which course is right for you as you take this exciting step into a prosperous future.

Get in touch with one of our consultants today and we will endeavour to help you.

Published date: Feb 2024